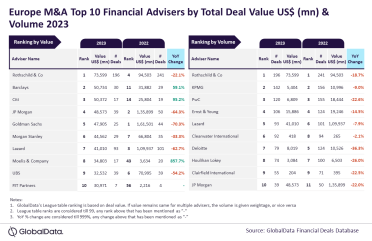

According to the latest league table from leading data and analytics company GlobalData, the financial adviser Rothschild & Co dominated the mergers and acquisitions (M&A) landscape in Europe in 2023.

Leading the way in both value and volume, an analysis of GlobalData’s Deals Database reveals that Rothschild & Co achieved this position by advising on 196 deals worth £73.6bn.

GlobalData lead analyst Aurojyoti Bose explained: “Despite experiencing a decline in deal volume and value in 2023 compared to 2022, Rothschild & Co outpaced its peers by a significant margin. However, it fell short [by] only four deals to touch the 200 deals volume mark during 2023.

“Rothschild & Co was the only adviser to surpass $70 billion in total deal value during the year. The company advised on a total of 21 billion-dollar deals in 2023, including one mega deal valued at more than $10 billion.”

Other top financial advisers for M&A in Europe

Barclays occupied the second position in terms of value, advising on $50.7bn worth of deals. It was followed by Citi with $50bn, JP Morgan with $48.6bn, and Goldman Sachs with $47/9bn.

KPMG occupied the second position in terms of volume with 142 deals, followed by PwC with 120 deals, Ernst & Young with 160 deals and Lazard with 93 deals.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFor H1 2023, Goldman Sachs and Houlihan Lokey were the top financial advisers for M&A.