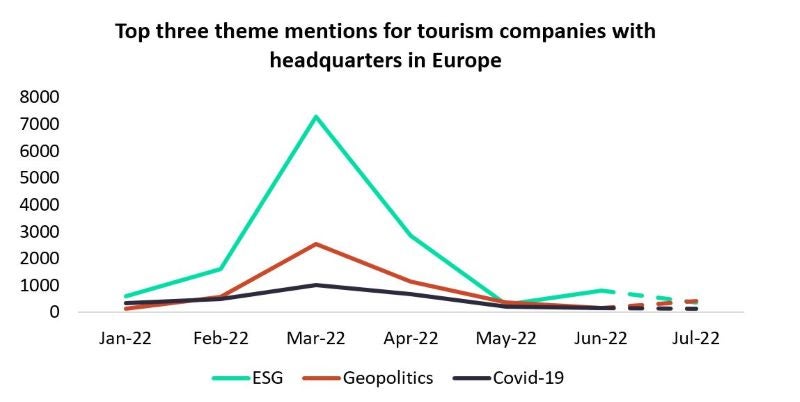

GlobalData’s Company Filing Analytics Database reveals the top three themes mentioned by European tourism companies so far in 2022, indicating the most pressing issues that the continent’s tourism industry faces. Environment, social, governance (ESG) takes the top spot while Covid-19 remained a key theme, along with geopolitics.

ESG remains a key theme

As shown by GlobalData, ESG is the most mentioned theme, totalling nearly 14,000 mentions in 2022 (as of 28 July 2022), demonstrating its importance. EU law requires many large-scale companies to disclose information on the way they operate and manage social and environmental challenges. However, many travellers now also demand greater transparency from companies and are increasingly wary of greenwashing attempts. This level of scrutiny from lawmakers and consumers has forced travel companies of all sizes to put ESG matters at the core of their operations.

Furthermore, few industries are as complexly intertwined with ESG, particularly the causes and effects of climate change, as tourism. As a resource-intensive industry, its components, including transportation and hospitality, continue to drive global warming while potential overcrowding puts pressure on natural environments and local communities.

Geopolitics mentions peaked in March

GlobalData’s Company Filing Analytics Database shows that mentions of ‘Geopolitics’ peaked in March 2022, with 2,562 mentions in this month alone, an increase of 338% from the previous month. This will have come as many companies reacted to Russia’s invasion of Ukraine. The ongoing Russia-Ukrainian conflict has had a limited impact on travel companies and tourism demand within Europe. A recent European Travel Commission survey showed that approximately 44% of European respondents stated that the conflict did not affect their holiday plans at all, and only 4% completely cancelled their trip. While travel demand is likely to prevail, the Russian invasion of Ukraine triggered high inflation.

A GlobalData consumer survey shows that 66% of European respondents are ‘extremely’ or ‘quite’ concerned about the impact of inflation on their household budget*. Tourism outlook could be endangered by the repercussions as the ultimate consequence is the erosion of disposable incomes. It remains to be seen how households across Europe (especially lower-income earners) will make a trade-off in terms of travel spending.

There are several possibilities for travel here: holidaymakers may opt to not travel, may travel domestically rather than internationally, travel to a destination which they perceive to be more affordable, or trade down e.g. stay at a budget hotel rather than a midscale one.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCovid-19 concern declines as travel returns

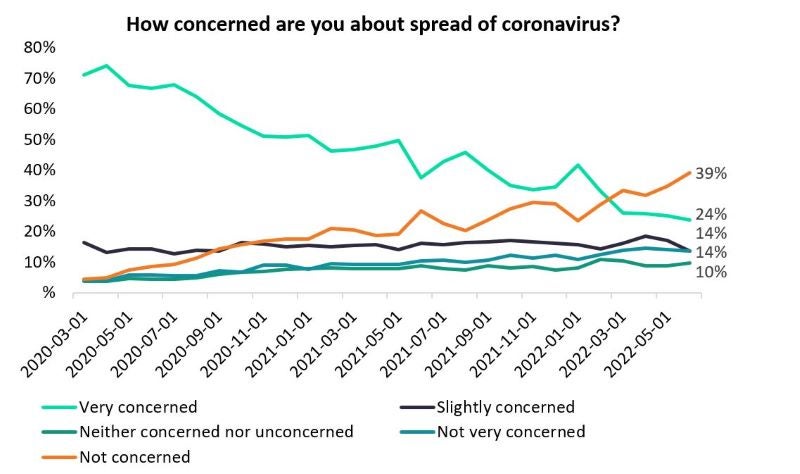

Covid-19 remained a key theme, with more than 3,000 mentions so far in 2022. However, from January 2022 to June 2022, Covid-19 mentions declined by 54%, suggesting that the theme is slowly losing momentum. Concurrently, a GlobalData poll revealed that 53% of global respondents are ‘not concerned’ or are ‘not very concerned’ about the spread of Covid-19, amid easing travel restrictions and rising vaccination rates**.

While Covid-19 is likely to remain a feature in company filings for the foreseeable future, there is reason to be cautiously optimistic as GlobalData forecasts that international departures from European countries will increase by 125% from 2021 to 2022. Tourism companies that are able to successfully navigate these themes through investment, management, and strategy will remain or emerge as industry leaders.

*GlobalData Q2 2022 Consumer Survey – 21,688 total respondents, 2,870 European respondents

**GlobalData Poll – Live, 236,746 Responses (Extracted July 28, 2022)