Chinese-based online travel player, Trip.com Group, has emerged as a global leader despite ongoing COVID-19 challenges while operating in a highly competitive tourism industry. The Group’s success can largely be attributed to a series of strategic partnerships and innovative marketing solutions.

COVID-19 adversely affected many aspects of Trip.com’s business

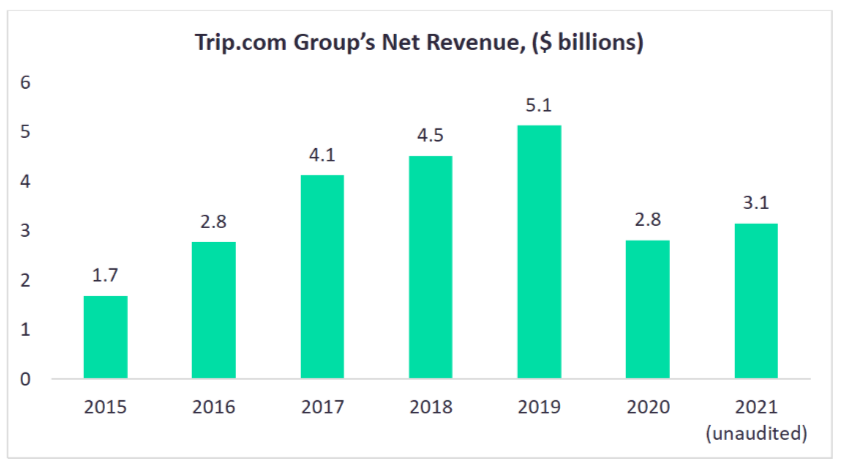

Trip.com Group, which operates under a portfolio of brands, including Ctrip, Qunar, Trip.com and Skyscanner, has risen to become one of the world’s leading online travel intermediaries in terms of revenue. Outside of COVID-19 times, Trip.com Group’s net revenues grew at a Compound Annual Growth Rate of 22.8% from 2016 to 2019, reaching $5.1 billion in 2019, according to the company’s financial statements.

COVID-19 has adversely affected many aspects of Trip.com’s business as the pandemic induced a significant decline in travel demand, cancelations and refund requests. In 2020, Trip.com Group saw its net revenue decline by 45.2% year-on-year (YoY) to $2.8 billion. For 2021, Trip.com Group reported its unaudited net revenue’s to be $3.1 billion, representing a 11.9% YoY increase from 2020. This growth in revenue was despite various COVID-19 mutations which triggered lockdowns in both China and overseas markets throughout 2021.

The Group’s strengths lie in strategic investments and marketing capabilities

Nevertheless, Trip.com Group has largely weathered the COVID-19 storm in part owing to the company’s series of strategic partnerships and investments, which forms a core part of the company’s domestic and international growth strategy. For instance, Trip.com Group’s international ambitions are clear when looking at the series of strategic partnerships and investments the company has made in the past. Trip.com Group has increased its foothold in India, one of the world’s largest source markets, following a $180 million investment in January 2016 and a further $33 million investment in October 2017. In doing so, Trip.com Group became the largest shareholder of India’s MakeMyTrip, wielding 49% of MakeMyTrip’s voting power.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAnother key strength of Trip.com Group is its innovative market strategies which are paying dividends. At the beginning of 2020, Trip.com Group launched a livestreaming platform, which has emerged as a pillar of Chinese e-commerce, to promote travel destinations across China. Since then, more than 3,000 partners have hosted over 10,000 live streams on the platform. Livestreaming on the company’s own livestreaming program, BOSS Live Broadcast, reportedly contributed $786.8 million in trading volumes from March 2020 to the end of 2020.

Challenges remain amid Trip.com Group’s expansion

As the Group’s domestic and global expansion powers on, Trip.com must contend with a significant number of challenges. This includes China’s evolving internet landscape and regulatory change which saw the dismantling ‘walled gardens’, which prevented users from sharing links to posts and products on other companies’ platforms. In addition, in 2020, Trip.com navigated “Operation Cyber Sword”, a wide-ranging campaign intended to reimagine China’s technology sector. This included regulating live commerce, managing unfair competition and strengthening the supervision of internet advertising.

Furthermore, one of the greatest threats to Trip.com Group is the intense competition it faces, both domestically and abroad. The online travel agency sector is seeing increasing consolidation, with Booking Holdings and Expedia Group emerging as its dominant players, according to annual revenue. However, Trip.com Group is in a strong market position, which coupled with innovative marketing solutions, strategic investments and merger and acquisition activity, stands the Group in good to stead to rival incumbent players

Related Company Profiles

Booking Holdings Inc

Expedia Group Inc

Trip.com Group Ltd

MakeMyTrip Ltd