Hyatt Hotels Corporation has revealed its financial results for the third quarter (Q3) of 2023, reaching new heights.

Hyatt witnessed a substantial surge in net income, reaching $68m in Q3 2023, compared to $28m in the same period of the previous year. Adjusted net income rose to $75m, surpassing $72m in Q3 2022.

Diluted earnings per share (EPS) rose to $0.63, up from $0.25 in Q3 2022, with adjusted diluted EPS at $0.70, exceeding the previous year's $0.64.

Despite adjusted earnings before interest, tax, depreciation and amortisation slightly decreasing to $247m in Q3 2023, the company demonstrated resilience in a dynamic market.

Robust net growth

The company reported an 8.9% increase in comparable system-wide revenue per available room, driven by a robust 6.2% net growth in rooms.

Hyatt's president and CEO, Mark S Hoplamazian, credited the success to a robust core business, leading to a 25% improvement in total fees for the first nine months of 2023 compared to the previous year.

Segment performance

The Americas demonstrated steady demand across a number of segments, while the Asia-Pacific region experienced a remarkable 55.1% growth.

Europe, Africa, and the Middle East showed resilience, overcoming challenges from a termination fee in 2022.

The Apple Leisure Group faced headwinds due to foreign currency fluctuations and challenging year-on-year comparisons, but initiatives to mitigate their impact are underway.

Expanding portfolio

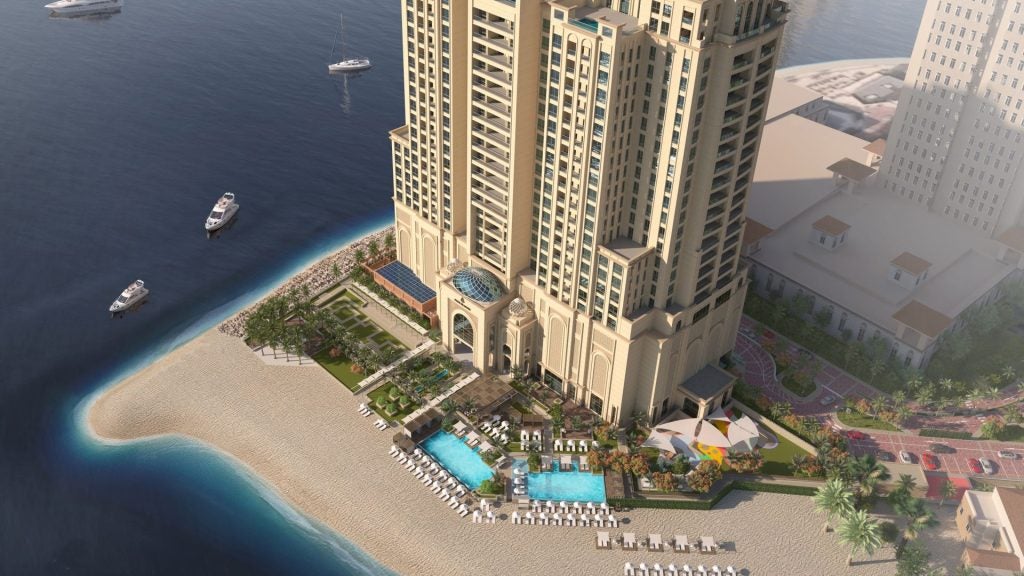

During Q3 2023, Hyatt opened 20 new hotels, adding 3,262 rooms to its global portfolio.

Notable additions include the Calistoga Motor Lodge & Spa in California, US, and Andaz Macau, the largest Andaz property globally.

The pipeline of executed management or franchise contracts reached an all-time high of approximately 123,000 rooms.

Strategic transactions and financial outlook

Hyatt successfully divested its destination residential management business and remains committed to realising $2.0bn in gross proceeds from real estate sales by the end of 2024.

As of September 30, 2023, the company reported total debt of $3.055bn, total liquidity of approximately $2.2bn, and a share repurchase authorisation of $1.2bn.

Dividend declaration

The board of directors declared a cash dividend of $0.15 per share for Q4 2023, underscoring Hyatt's commitment to delivering value to shareholders.

Hyatt's impressive Q3 performance reflects its resilience, strategic initiatives and global market adaptability. The company anticipates sustained growth, driven by a robust pipeline and strong demand for travel worldwide.