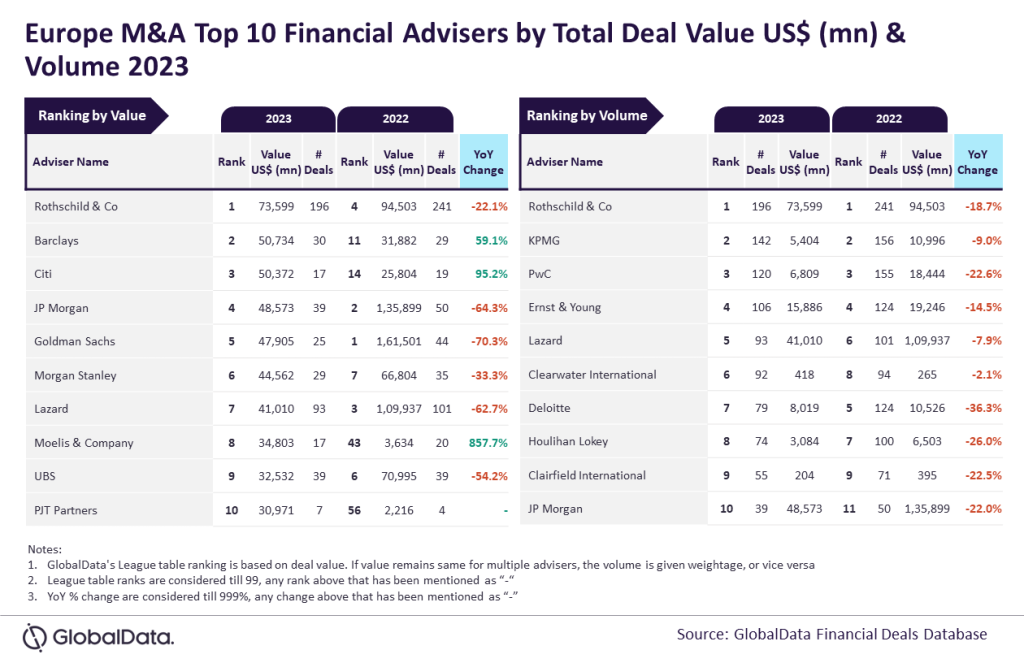

According to the latest league table from leading data and analytics company GlobalData, the financial adviser Rothschild & Co dominated the mergers and acquisitions (M&A) landscape in Europe in 2023.

Leading the way in both value and volume, an analysis of GlobalData’s Deals Database reveals that Rothschild & Co achieved this position by advising on 196 deals worth £73.6bn.

GlobalData lead analyst Aurojyoti Bose explained: “Despite experiencing a decline in deal volume and value in 2023 compared to 2022, Rothschild & Co outpaced its peers by a significant margin. However, it fell short [by] only four deals to touch the 200 deals volume mark during 2023.

“Rothschild & Co was the only adviser to surpass $70 billion in total deal value during the year. The company advised on a total of 21 billion-dollar deals in 2023, including one mega deal valued at more than $10 billion.”

Other top financial advisers for M&A in Europe

Barclays occupied the second position in terms of value, advising on $50.7bn worth of deals. It was followed by Citi with $50bn, JP Morgan with $48.6bn, and Goldman Sachs with $47/9bn.

KPMG occupied the second position in terms of volume with 142 deals, followed by PwC with 120 deals, Ernst & Young with 160 deals and Lazard with 93 deals.

For H1 2023, Goldman Sachs and Houlihan Lokey were the top financial advisers for M&A.